FX Pre-Agreed Spread Agreements

The Importance of FX Pre-Agreed Spread Arrangements

Pre-agreed FX spreads are a key safeguard for clients operating in a foreign exchange market where banks do not act in a fiduciary or advisory capacity. This means banks are not required to prioritize the client’s best interest and instead act as counterparties aiming to maximize their own profitability. Most banks retain broad discretion in how they determine pricing and markups, citing a wide array of factors such as transaction size, currency pair, market volatility, and liquidity. Because these factors are loosely defined, banks effectively reserve the right to adjust spreads as they see fit, often without disclosing how those decisions are made or the revenue they expect to earn from a transaction.

This lack of transparency is compounded by the fact many banks do not reveal the specific components of the all-in rate or provide a breakdown of how the final price is derived. In addition, numerous banks apply “Last Look” policies, allowing them to perform final checks on trade pricing and validity before execution—and to reprice or reject the trade without disclosure if market conditions shift. A pre-agreed spread helps mitigate these risks by establishing consistent, upfront pricing. It limits the bank’s ability to manipulate markups at their discretion and provides clients with greater predictability and fairness in trade execution, particularly when transparency and alignment of incentives are otherwise lacking.

FX Pre-Agreed Spread Arrangements & Library Samples

Sample A-Pre-Agreed Spreads

In this sample, we observe that Company A has established a Pre-Agreed Spread Arrangement with Bank A. Under this arrangement, the agreed spread is set at 10 basis points over the True Interbank market rate. It is important to note that Bank A explicitly states it is not acting in a fiduciary capacity, meaning it does not represent the interests of Company A in the transaction and may have its own economic incentives. Furthermore, Bank A applies a “Last Look” policy, which allows it to conduct a final check on the validity and pricing of a trade before execution—potentially rejecting the trade if market conditions have shifted.

Bank A also operates across at least three different trading channels and engages in transactions involving a broad range of currencies, dealing with at least ten different currency pairs. This setup reflects a relatively complex trading environment with multiple execution venues and significant operational discretion on the part of Bank A.

Sample B-Counterparty- NOT a Fiduciary

In this sample, Company B has entered into a new Pre-Agreed Spread Arrangement with Bank B. Similar to Bank A, Bank B does not act in a fiduciary capacity, but it reserves the right to deviate from the agreed spread based on a wide range of operational and market factors, including transaction costs, execution channels, client credit risk, and the overall client relationship. Bank B’s spread schedule is more detailed than Bank A’s, featuring an 8-basis point markup that varies depending on transaction type.

The agreement also notes that trade execution may be delayed due to data interruptions, for which Bank B accepts no liability and may cancel trades if disruptions occur. Like Bank A, Bank B also implements a “Last Look” policy.

Sample C-Standardized Spread

In this sample, we see that Company C has a Pre-Agreed Spread Arrangement in place with Bank C. Similar to other arrangements, the agreed spread is set at 10 basis points over the Interbank market rate. While it is not explicitly stated, it is implied that Bank C is not acting in a fiduciary capacity, meaning it is not obligated to prioritize Company C’s best interests in the transaction process. Furthermore, Bank C's pricing practices lack full transparency, as it does not clearly disclose how markups are calculated or which specific factors influence the rates provided. Unlike Bank A, Bank C does not mention implementing any policy such as “Last Look,” leaving it unclear whether they reserve the right to reject or delay trades based on post-submission price or validity checks. Overall, the relationship between Company C and Bank C reflects a standardized spread arrangement with limited insight into execution practices or pricing methodology.

Individual Summaries from Bank Websites

Wells Fargo

Foreign Exchange Dealing & Business Practices Disclosure

This document discloses relevant practices of Wells Fargo Bank, N.A. (“WFBNA”) and Wells Fargo Securities International Limited (“WFSIL” and, together with WFBNA and its branches, “WF”, “we”, “us” or “our”) when acting as a dealer in the over-the-counter (“OTC”) foreign exchange (“FX”) market and it clarifies certain aspects of the foreign exchange trading relationship between you and WF. We urge you to consider this information in deciding whether to transact FX or place FX orders with us as our counterparty ("you" or" counterparty"). By dealing with or continuing to deal with WF you are deemed to have consented to and agree to deal with WF under and in accordance with the terms hereof, as amended through the date on which the parties have entered the applicable FX transaction.

Applicability and Scope

The information provided in this disclosure applies to any FX transactions you execute or discuss with us, subject to the terms of any written agreement between you and us, and supplements any other disclosures that we may furnish to you in connection with FX transactions or swap transactions, including through our Disclosure of Material Information for Swaps website. In the event of a conflict between the terms of this disclosure and such other agreement or disclosures, the terms herein shall prevail, provided, however, if such other agreement or disclosures meet requirements under applicable law (such as those specific to a particular jurisdiction or product), such other terms shall prevail.

Principal Trading

WF acts as principal on an arm’s length basis, does not act as your agent, fiduciary, financial advisor or in any similar capacity, and does not provide you with “best execution” for orders or transactions unless otherwise agreed in writing or required under applicable law. You and WF, as counter parties, or you and one or more other counterparties of WF may have divergent or conflicting interests from time to time. Each counterparty is expected to evaluate the appropriateness of any transaction, based upon its own circumstances and assessment of costs, benefits and risks. Statements made by WF should not be construed as recommendations or advice.

Market Making

WF is a dealer and market maker in the foreign exchange market. As such, we engage in price quoting, order taking, trade execution and other related activities with counterparties and other dealers and for our own account. As a market maker, WF may receive requests from multiple counterparties for quotations and multiple orders for the same or related currency pairs, and while customer service is a high priority for us, WF also manages its own independent risk management objectives. These activities may conflict with or adversely impact your interests, including the prices we offer you and the availability of liquidity at levels necessary to execute your order. They can also impact prices and trigger stop loss orders, barriers, knock-outs, knock-ins and similar conditions of FX transactions we may execute with you.

FX Markup Arrangements

Following is what we suggest you have included in Pre-Agreed FX Spread (Markup) Written Agreements:

1. A confirmation of Pre-Agreed FX Spreads for certain FX Flows. For example, FX Markups at 2Bps. (Based on Annual FX Flow and Characteristics.....5 BPs, 10 BPs, 20 BPs, etc.)

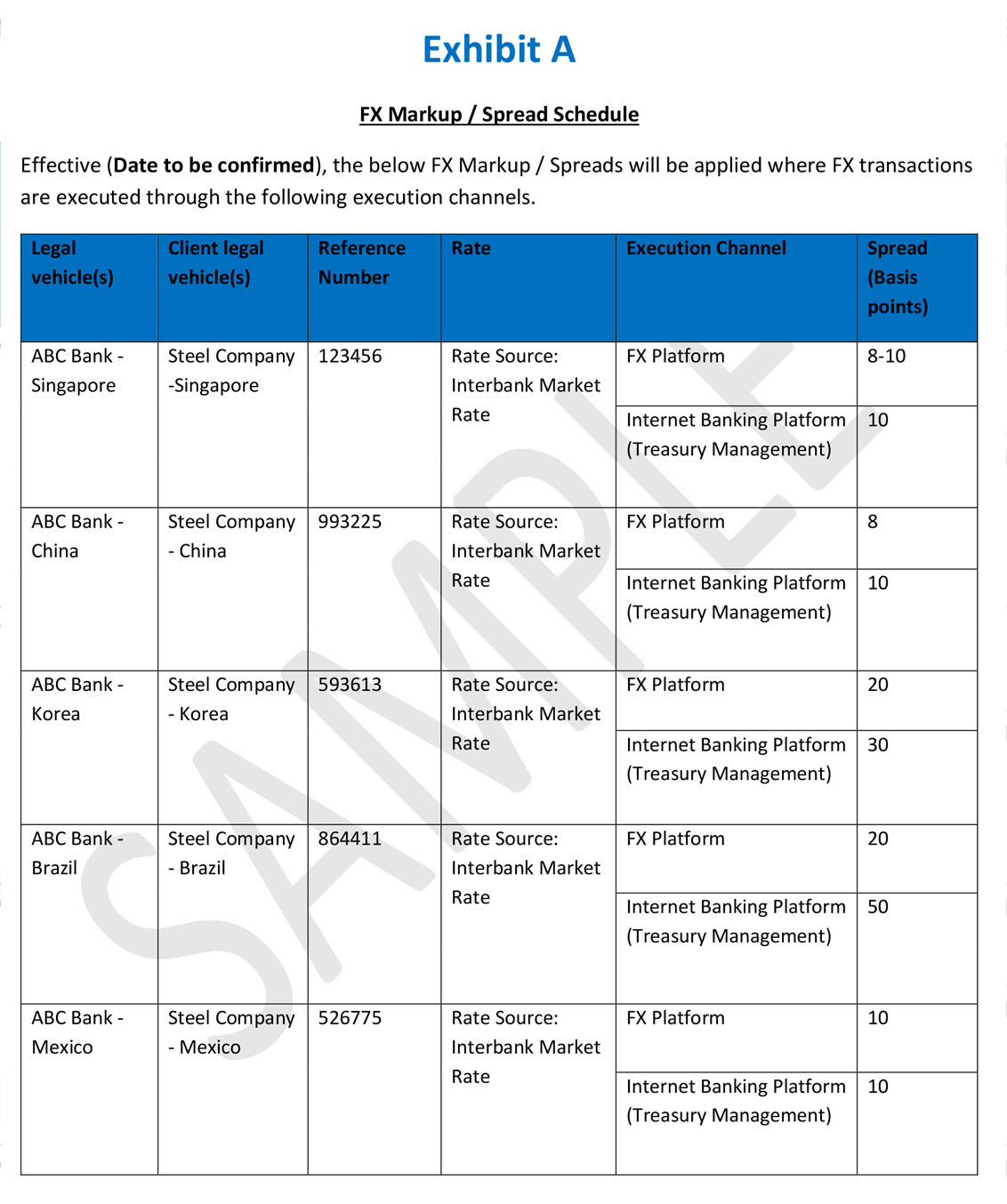

2. An FX Arrangement for FX transactions, via certain FX payment channels as outlined in an Attached Exhibit A Schedule, to show the spreads for various subsidiaries.

3. The Spread should be over the Interbank Market Rate as determined by historical FX Rate data found on Bloomberg, Refinitiv, or other acceptable market sources.

4. Require that if the Bank is Unable, or Chooses Not to do, an FX Trade at the “Rate” and “Spread” specified in the FX Spread Schedule, it will try to promptly Inform and Notify the Client.

5. The Client should understand that the Bank may not apply the agreed FX Spread, or FX Rate, due to Operational, Market, Legal or Credit issues and this will likely be explained and referenced in the Agreement.

6. There should be an understanding that should the Bank not be able to Maintain FX Markups as agreed, for any reason, that the Client is free to move its FX Flow to another Bank.